Research Article: 2019 Vol: 18 Issue: 4

Board Financial Education and Firm Performance: Evidence from the Healthcare Sector in Nigeria

Jonah Arumona, Bingham University, Nigeria

Olayinka Erin, Covenant University, Nigeria

Lucky Onmonya, Institute of Development Finance and Project Management, Nigeria

Vincent Omotayo, Wesley University, Nigeria

Abstract

This study examines the relationship between board financial education and firm performance of companies operating in the healthcare sectorin Nigeria. The study investigates six (6) listed firms in the healthcare sector for the period from 2011 to 2017. Board financial education variables were proxy by bachelor’s degree in finance related courses (BScFin), a postgraduate degree in finance related courses (PGFin) and professional qualification in finance related courses (POFin) while the study controlled for other variable which is the firm size (FMZ). Firm performance was measured using the return on assets (ROA). The fixed effect model of the multiple regression analysis was adopted in testing the three hypotheses developed in this study. The empirical result revealed that all the explanatory variables have a positive and significant relationship with firm performance. This result emphasizes the relevance of financial education for board members irrespective of their educational background. We, therefore, recommend that financial literacy should be considered as a primary pre-requisite for appointments to corporate boards. Also, basic financial training should be a top priority for all firms to assure optimum financial performance. This study provides original insight into board financial education variables that affect the performance of firms operating in the healthcare sector in Nigeria. The study’s finding carries significant importance for company executives, regulatory authorities, policymakers, and future researchers.

Keywords

Board Financial Education, Firm Performance, Financial Expertise, Firm Size, Healthcare Sector in Nigeria.

Introduction

The health care sector has historically viewed itself as being operationally different from other businesses. The private healthcare sector plays a large role in the delivery of high-quality care services in many healthcare systems as it accounts for over 62% in Nigeria (African Progress Report, 2017). Despite the size and expected future growth of the private health sector, there are several challenges that hinder its potentials for impact in the overall health system. These according to them include poor healthcare, weak infrastructure, drug counterfeiting particularly in rural areas, lack of appropriate data systems for patient information and financial records and heavy fragmentation of the sector that limits the scalability of interventions and activities that create barriers to accessing much-needed growth capital for the sector (African Progress Report, 2017). According to Seetharaman et al. (2010), the operational cost of healthcare has steadily risen, usually faster than the consumer price index, absorbing a larger proportion of the Gross National Product (GNP). Vian (2008) argues that the bane of the healthcare sector is corruption which has negatively affects the delivery of effective health care and social welfare. These problems result in a heavy outflow of much needed foreign exchange as a result of medical tourism abroad and brain drain. It has been estimated that Nigerians spend over $1 Billion dollars annually on medical tourism (NEEDS, 2004).

As the private sector dominates the Sub-Saharan African health provision landscape, the success of the private healthcare sector will be critical to the quality of the overall health outcomes and by extension the improvement in the macro-economy and increased national welfare. The sustainability of this sector depends on the institutionalization of strong corporate governance. Akinsulire (2006) and Horner (2016) agree that corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation such as the board, managers, shareholders and other stakeholders, and spells out the rules and procedures for making decisions on corporate affairs. This then provides the structure through which the company’s objectives are set and communicated; the means of attaining them as well as monitoring performance are specified. The need to investigate the impact of board characteristics especially board financial education on company performance arise as a result of high profile corporate failures around the world (Oyeleke et al., 2016; Hernsberger, 2016; Shammari, 2018).

Countries all over the world have taken giant strides to ensure good corporate governance due to the negative effect of corporate failures on organizations and national institutions. Erin et al. (2017) posit that one of the steps taken is to diversify the board by including directors with financial expertise or background. In Nigeria, a response has been made by Securities and Exchange Commission (SEC) in collaboration with the Corporate Affairs Commission (CAC) by launching a Code of Corporate Governance for Nigerian public companies in 2003 and was further reviewed in 2011. One of the main provisions of the code for corporate governance centered on the financial expertise of the board of directors (SEC, 2004). The board is held responsible for all the activities of the company and even for the failure of other elements of the corporate governance chain. The shareholders are helped in this regard by statutory and regulatory provisions and institutions but by far the strength of the internal control mechanism is more germane to the success of the company than all external control measures. Since the internal control mechanism is essentially established by the Board, it exercises utmost control over the safety and most economic use of the resources of the enterprise.

Several authors (Kirkpatrick, 2009; Ame et al., 2017; Erin et al., 2017) argue that the failure of most financial institutions was due to the lack of financial expertise of board members. Consistent with this argument, Uwuigbe et al. (2017) opine that board oversight functions cannot be left in the hands of board members who know-nothings in financial matters. They further argue that a large number of board members that are financial illiterates put the organization at a financial risk. Because when it comes to the financial discussions, many board members “zone out”. Without an appropriate level of financial understanding, the right questions may never be asked, which eventually may affect the company’s performance.

Firm’s financial performance is an important concept that relates to the way and manner in which financial resources available to an organization are judiciously used to achieve the overall corporate objective of that organization, keeps it in business and creates a greater prospect for future opportunities. The ways a firm invests shareholders’ funds determines its performance and goes a long way in determining its ability to achieve its objectives. There are many measures of firm performance. In most empirical studies (Barnhart et al., 1994; Kiel & Nicholson, 2003; Sar, 2018) on corporate governance; firm performance is measured using both market-based measures and accounting-based measures. Return on Equity (ROE), Earnings per Share (EPS) and Return on Assets (ROA) are the most commonly used in accounting-based measures. While Tobin’s Q and market to book value ratio are the most used measure in market-based performance measures. None of the market-based measures will be employed in this research due to the absence of available data. This study employed the accounting-based performance measure with ROA as a proxy to measure financial performance. This study, therefore, examined the effects of board financial education on firm performance with particular reference to the Nigerian healthcare sector.

Literature Review

Most studies after the financial crisis of 2008 shifted focus from board independence, which is nowadays heavily regulated, to board quality. Board quality represents the quality of the board members in relation to their educational qualifications, industry experience and age. The study of Pozen (2010) and Bertsch (2011) found that industry experience alone is not sufficient to tackle wide issues in corporate governance model. They found that financial education coupled with industry experience positively influences corporate performance. Research in psychology suggests that educational diversity helps to improve firm performance especially from group composition theory (Dobbin & Jung, 2011). In the upper-echelon theory, Hambrick and Mason cited in Haniffa & Cooke (2008) believes that managerial educational background has a significant influence on the organizational outlook, corporate performance, and strategic business models. Consistent with this view, Hitts & Tyler (1991) reveal that the educational background of corporate executives affects organizational strategic decisions which invariably impact firm performance. The findings of Graham & Harvey (2002) reveal that CEOs with MBA are more knowledgeable in using financial models in evaluating projects that have a positive and significant impact on the organization.

Smith et al. (2006) posit that a study on financial education within the corporate governance context is few in literature. Most studies conducted on board financial education and financial performance was mostly done in the US. However, in recent times studies from other countries began to pay more attention to board financial literacy and education (Peters et al., 2010; Kahveci & Wolfs, 2019). Agrawal & Chadha (2005), in their study, concluded that organizations that have an independent director with a background in accounting or finance have a higher probability to improve earnings compared to other firms with non-accounting or finance background. Similarly, Haniffa & Cooke (2008), study corroborated the findings of Agrawal & Chadha (2005), that board members with financial education have the potential for delivering improved firm performance.

In fact, the amendments to the United States Securities and Exchange Commission’s disclosure rules in 2009 intend to increase, among others, director qualifications, thereby also reflecting an increased interest in director qualifications and experience (Okoye et al., 2017). The nexus between education and performance was empirically studied extensively in the US and lately in researches conducted in other countries particularly in developing ones. Hambrick et al. (1996) showed that the average education level of top management team members is positively associated with the growth in market share and growth in profits. Golec (1996) showed that holders of MBAs manage investment funds that perform better. In line with the above, Chevalier & Ellison (1999), revealed that managers of funds that attended higher-SAT undergraduate schools perform more. This revelation is in tandem with Gottesman & Morey (2006), who identified a positive association between the quality of MBA programmes attended by the managers and fund performance.

Again, Jalbert et al. (2002) showed that the reputation of a CEO’s graduate institution is positively correlated with Return on Assets (ROA). Haniffa & Cooke (2008) found that there is a positive link between accounting and general business education of directors of board and disclosure of information in financial statements. In addition, Yermack (1996) illustrated that share price reactions are sensitive to director’s professional qualifications, especially in the field of accounting and finance. Darmadi (2011) found that the educational qualifications of board members including the CEO matter for either return on assets which is an accounting-based performance measure or Tobin’s Q which is a market- based performance measure.

Theoretical Perspectives

The study of Bathula (2008) identified three major areas of theoretical perspectives underpinning the discussion on board characteristics and corporate governance mechanisms. These include: agency theory, stewardship theory, and stakeholder theory.

Agency theory

This theory has been examined widely especially in corporate governance research. It is with the view that there is a relationship between the principal (owners) and management (agent). Sometimes this relationship leads to a conflict of interest between the owner and the agent (Berle & Means cited in Ame et al., 2017; Jensen & Meckling cited in Okwoli et al., 2018; Eisenhardt, 1989). The agency conflict arises when managers give less attention to shareholder due to selfish interest and self-centeredness. In essence, the managers cannot be trusted and therefore there is a need for strict monitoring of management by the board, in order to protect shareholder’s interest. The monitoring of management activities is seen as a fundamental duty of a board, so that agency problems can beminimized, and superior organizational performance can be achieved.

Stewardship theory

This is a governance theory that explains that managers (agents) are trustworthy and credible stewards of the resources entrusted to them. This assertion makes strict monitoring of management redundant (Donaldson, 1990; Donaldson & Davis, 1991). Stewardship theory suggests that managers should be given autonomy based on trust, which minimizes the cost of monitoring and controlling the behavior of the managers and directors. Also, stewardship theory believes that factors that influence manager’s decisions are non-financial issues. Such factors include satisfaction of successful performance, need for achievement and recognition, respect for authority and the work ethics.

Stakeholder theory

Stakeholder theory views “companies and society as interdependent and therefore the firm serve a broader social purpose than its responsibilities to shareholders” (Kiel & Nicholson, 2003). Likewise, Freeman cited in Awotundun (2015), one of the original proponents of stakeholder theory, defines stakeholder as “any group or individual who can affect or is affected by the achievement of the organization’s objectives”. This research adopts the agency theory to guide the study.

Research Methodology

The research design for this study is an ex-post factor. According to Kerlinger (1999), ex- post facto research is also called causal-comparative research and is used when the researcher intends to determine cause and affect relationship between independent and dependent variables with a view to establishing a causal link between them. This research design was employed because of its suitability in research of this nature. The population consists of all quoted firms in the Nigerian Health sector as listed by the Security and Exchange Commission (SEC) as at 31st December 2017. The total number of Healthcare firms listed as at that period was eight (8). Table 1 shows the list of firms in the sector with their respective years of listing.

| Table 1: LIST OF SAMPLED FIRMS | ||

| S. No | Names of Companies | Year Listed |

|---|---|---|

| 1 | GlaxoSmithKline Consumer Nig. Plc | 2000 |

| 2 | May and Baker Nig. Plc | 1994 |

| 3 | Neimeth Int. Pharmaceuticals Plc | 1979 |

| 4 | Pharma-Deko Nig. Plc | 1980 |

| 5 | Fidson Healthcare Plc | 2008 |

| 6 | Morison Industries Plc | 1998 |

| 7 | Nigeria-German Chemicals Plc | 1997 |

| 8 | Evans Medicals Plc | 1979 |

A sample size was generated from the population. All but two of the companies made the sampling list. The two firms that could not make the sampling list were as a result of the unavailability of data. These firms are Evans Medicals Plc and Nigeria-German Chemical Plc. Therefore, 6 (six) firms out of the 8 listed firms made up the sampling list for this study.

Hypotheses Development and Model Specification

The board members financial expertise is measured by an observable indicator of educational qualification. According to Iona?cu & Olimid (2011), educational qualification is viewed in literature as an appropriate proxy for intellectual competence. Content analysis of annual reports was conducted in order to measure the qualification of members of the board. In conducting this study, we adopted seven financial fields of the educational backgrounds of board members. These are; degrees in Accounting, Finance, Business, Management, Banking, Marketing, and Economics obtained from any recognized university as the first proxy, Master degree in the relevant finance related courses, and doctorate degree as the second and Professional qualification in any of the finance field. Degrees in finance-related fields are capable of providing board members with financial competence that could assist them to perform their duties more competently, which in turn enhanced the firm performance. Consequently, we formulate the following hypotheses to be tested in firms in the Healthcare sector of Nigeria:

H01: The size of board members holding degrees in finance-related disciplines do not significantly affect firm performance.

The size of board members holding degrees in finance-related disciplines was derived by dividing the number of Board members holding such degrees to the entire number of board members. Iona?cu & Olimid (2011) and Bhagat et al. (2010), postulate that educational level is a proper proxy for skill. Graham & Harvey (2002), posit that the higher the educational level the greater the performance. Consequent on this, the second hypothesis would be tested is as follows:

H02: The size of board members holding postgraduate degrees in finance-related disciplines do not significantly affect firm performance.

Postgraduate degrees include Master degrees, Doctor of Philosophy degrees (PhDs) and their equivalents which were obtained from either local or foreign universities. We also formulated the third hypothesis for testing:

H03: The size of board members holding professional qualifications in finance-related disciplines do not significantly affect firm performance.

The professional qualifications are those internationally acclaimed and recognized in Accounting, Banking, Management/Administration, Economics, Marketing and others in the field of finance.

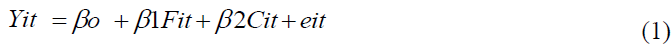

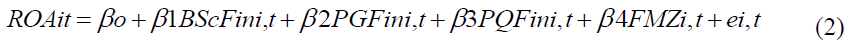

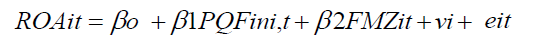

This study employed a modified version of the econometric model of Miyajima et al. (2003) and Kyereboah-Coleman & Biekpe (2005). The Econometric model of Miyajima et al. (2003) and also adapted by Oki (2015), is represented as:

Independent variables

The main variable is the board members’ education. The index was used, aggregating different levels of education namely:

The modified version is stated as:

Where,

ROA=Return on Assets (i.e., a proxy for firm financial performance).

BScFin=Bachelor of Science degree in any financial disciplines.

PGFin=Postgraduate degree in finance related disciplines.

PQFin=Professional qualifications in finance-related disciplines FMZ=Firm Size.

β0=Intercept of the model.

β1=Coefficient of First Degree.

β2=Coefficient of Postgraduate qualifications.

β3=Coefficient of Professional qualification.

β4=Coefficient of the control variable (firm size).

e=The error term which accounts for other possible factors that could affect the dependent variable not captured in the model.

i=1, 2, 3………6 indicating the number of firms used for the study.

t=1, 2, 3…….7 indicating the time period used for this study (2011-2017).

The apriority is such that β0, β1, β2, β3, β4 > 0 The implication of this is that a positive relationship is expected between explanatory variables (BScfini,t; PGFini,t; PQFini,t) and the dependent variable. The size of the coefficient of correlation will help us explain various levels of relationship between the explanatory variables.

Results

This section presents the descriptive and inferential results obtained from the study and findings from the results are discussed on the basis of the literature.

| Table 2:Descriptive Analysis. | ||||

| Variable | Mean | Std Dev. | Minimum | Maximum |

|---|---|---|---|---|

| ROA | 0.2205 | 1.7082 | -1.952 | 10.763 |

| BscFin | 3.1219 | 0.7139 | 2 | 5 |

| PGFin | 1.5853 | 0.5905 | 0 | 3 |

| PQFin | 0.8292 | 0.6285 | 0 | 2 |

| Logfmz | 0.4657 | 0.6653 | -0.8 | 1.49 |

Note: ROA: Return on Asset; BScFin: First degree in finance field; PGFin: Postgraduate degree in finance field; PQFin: Professional qualifications in finance field.

Table 2 above shows the result of descriptive statistics test utilizing the data mean, standard deviation, minimum and maximum. The above statistics are obtained using STATA version 13 statistical package. The mean values of ROA, BScFin, PGFin, PQFin, and logfmz are 0.22, 3.12, 1.58, 0.83 and 0.46 respectively. The common feature of these variables is that they all have positive mean values. This means that each of the variables displays increasing tendency throughout the sampling period. The return on assets (ROA) ranges from -1.9 to 10.7 and deviated by 1.7. This shows that the maximum value of return on assets for the firms during the period of the study is N10.7 billion, while the minimum was a loss of N1.9 billion. The mean of the BSc holders in finance-related disciplines (BScFin) in a typical board of healthcare company is 3.12 while the minimum is 2 and the maximum is 5 and deviated by 0.7. The holders of postgraduate degrees give a mean value of 1.58 while the minimum size is 0 and the maximum is 3 with a standard deviation of 0.59. The holders of professional qualifications have a mean value of 0.83 and a minimum number of 0 and a maximum of 2. On the other hand, the average firm size among the firms in the healthcare sector is 0.47 with a standard deviation of approximately 67%. This indicates high variability among the firms implying that some of the firms have substantially higher total assets than others in the same sector.

Discussion

Regression Analysis and Discussions

To analyse the variables of this study, the panel data methodology was adopted because the study combined time series and cross-sectional data. The inferential panel regression analysis explains the effect of board financial education and the control variable on the financial performance of companies in the healthcare sector in Nigeria. For all regressions examined, the Hausman test was carried out in order to choose between random and fixed effects model. This assists us to reject the random effect and opted for fixed effect estimator.

The Hausman Taylor test

The hypothesis for this test is stated as follows:

H0: Difference in coefficients not systematic (Random Effect is preferred).

Ha: Difference in coefficients systematic (Fixed Effect is preferred).

Decision rule

If the p-value is less than 5% reject null hypothesis which means that the random effect is rejected but if otherwise, then do not reject the null hypothesis and reject alternative hypothesis. The result is summarised below:

From the Table 3 above, the observed p-value of BScFin, PGFin, and PQFin are; 0.014, 0.007 and 0.018 respectively all of which is less than the critical value at 5% (0.05). Therefore the null hypothesis which states that the individual effects do not correlate with the included variables is rejected. The fixed effect model which states that the difference in the coefficients is systematic is therefore accepted. The fixed effect model of the multiple regression analysis will be adopted in testing the three hypotheses in this study.

| Table 3: Summary Of Hausman Test | ||||

| Variable | Fixed | Random | Prob | X2 |

|---|---|---|---|---|

| BscFin | -0.456 | -0.369 | 0.014 | 8.46 |

| PGFin | -0.863 | -0.685 | 0.007 | 9.86 |

| PQFin | 0.37 | -0.427 | 0.018 | 7.94 |

| Logfmz | 7.353 | -0.172 | ||

Note: ROA: Return on Assets (dependent variable); BScFin: Degree in Financial disciplines; PGFin: Postgraduate degree; PQFin: Professional qualifications and Logfmz=the log of the firm size.

Source: Stata Output.

Test of the Hypothesis

H01: The size of board members holding degrees in finance-related disciplines do not significantly affect firm performance.

From the null hypothesis, we posit that there is no significant effect irrespective of the proportion of board members holding degrees in financial disciplines and the financial performance of companies in the Nigerian Health sector. The model is restated as:

The results in Table 4 above show that when ROA was utilized as the dependent variable to measure the performance of companies in the healthcare sector, the proportion of first-degree holders in the financial field has an overall p-value of 0.025 and f-test of 4.11. This implies that first degree holders in finance-related fields have a positive significant influence on the performance of companies in the healthcare sector in Nigeria. This means that for every increase in the number of first-degree holders in the financial field there is a significant impact on the performance of listed healthcare companies in Nigeria. This provides evidence supporting us to reject the null hypothesis one of the studies which states that the size of Board members holding degrees in finance-related disciplines does not significantly affect company performance in Nigeria. This finding supports the works of Chevalier & Ellison (1999), which showed that funds managers who attended higher-SAT undergraduate institutions perform better. The result also reveals that FMZ which was used as control variable and proxied bythe natural logarithm of total assets indicates that there is a positive and significant impact between FMZ and ROA for the period under study. The coefficient of FMZ is 7.353 while the probability value is 0.008 which is less than 0.05, indicating a statistically significant impact between the variables under study. The implication of this result is that an increase in the assets of the firm studied will lead to a corresponding increase in the Return on Assets (ROA). In other words, the larger the firm grows in size, the more the growth in the Return on Assets (ROA) of the firms.

| Table 4: Regression Result Of Return On Assets And First Degree In Financial Field | ||||

| Variable | Coefficient | Std Err. | t-stastics | p-value |

|---|---|---|---|---|

| PGFin | -0.456 | 0.522 | -0.87 | 0.389 |

| Logfmz | 7.353 | 2.621 | 2.8 | 0.008 |

| Constant | -1.851 | 1.971 | -0.94 | 0.355 |

| R2=0.0086 | ||||

Note: ROA: Return on Assets (dependent variable); PGFIN: Postgraduate degree in finance field; logfmz: The log of the firm size, t=t-test.

Source: Stata Result.

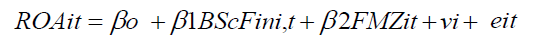

H02: The proportion of board members holding postgraduate degrees in finance-related fields does not significantly affect firm performance.

The null hypothesis posits that there is no significant effect on the performance of companies in the Nigerian Health sector irrespective of the proportion of board members holding postgraduate degrees in financial fields. The model is restated as:

| Table 5: Regression Result Of Return On Assets And Postgraduate Degree In Financial Field | ||||

| Variable | Coefficient | Std Err. | t-stastics | p-value |

|---|---|---|---|---|

| PGFin | -0.456 | -0.369 | 0.014 | 8.46 |

| Logfmz | -0.863 | -0.685 | 0.007 | 9.86 |

| Constant | 0.37 | -0.427 | 0.018 | 7.94 |

| R2=0.0066 | ||||

| rho=0.927 | ||||

| F-test=5.44 | ||||

Note: ROA: Return on Assets (dependent variable); PGFIN: Postgraduate degree in finance field; logfmz: The log of the firm size, t=t-test.

Source: Stata Result.

| Table 6: Regression Result Of Return On Assets And Professional Qualification In Financial Field | ||||

| Variable | Coefficient | Std Err. | t-stastics | p-value |

|---|---|---|---|---|

| PGFin | -0.3701 | 0.5137 | -0.72 | 0.476 |

| Logfmz | 7.0332 | 2.6213 | 2.68 | 0.011 |

| Constant | -2.816 | 1.3642 | -2.06 | 0.047 |

| R2=0.0090 | ||||

| rho=0.9102 | ||||

| F-test=3.96 | ||||

Note: ROA: Return on Assets (dependent variable); PQFIN: Professional qualifications in finance field; logfmz: The log of the firm size, t=t-test.

The results in Table 5 above show that when ROA was utilized as the dependent variable to measure the performance of companies in the healthcare sector, the proportion of first-degree holders in finance-related fields have an overall p-value of 0.009 and f-test of 5.44. This implies that postgraduate degree holders in finance-related fields have a positive and significant influence on the performance of companies in the healthcare sector in Nigeria. This means that for every increase in the number of postgraduate degree holders in finance-related fields, there is a significant effect on the performance of listed healthcare companies in Nigeria. This provides evidence supporting us to reject the null hypothesis two of the study which states that the size of Board members holding a postgraduate degree in finance related disciplines do not significantly affect company performance in Nigeria. The alternative hypothesis which states that the proportion of members holding postgraduate degrees in finance-related disciplines significantly affect company performance in Nigeria. The result also reveals that FMZ which was the control variable indicates that there is a positive and significant impact between FMZ and ROA for the period under study. The coefficient of FMZ is 7.377 while the probability value is 0.006 which is less than 0.05, indicating a statistically significant impact between the variables under study. The implication of this result is that an increase in the assets of the firm studied will lead to a corresponding increase in the Return on Assets (ROA). In other words, the larger the firm grows in size, the more the growth in the Return on Assets (ROA) of the firms. This work is in agreement with the earlier work of Haniffa & Cooke (2008), who found that more innovative banks are managed by more educated teams.

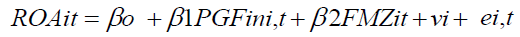

H03: The size of Board members with professional qualifications in finance-related disciplines does not significantly affect firm performance.

The null hypothesis posits that there is no significant effect on the performance of companies in the Nigerian Health sector irrespective of the size of board members with professional qualifications in finance-related disciplines. The model is restated as:

| Table 6: Regression Result Of Return On Assets And Professional Qualification In Financial Field | ||||

| Variable | Coefficient | Std Err. | t-stastics | p-value |

|---|---|---|---|---|

| PGFin | -0.3701 | 0.5137 | -0.72 | 0.476 |

| Logfmz | 7.0332 | 2.6213 | 2.68 | 0.011 |

| Constant | -2.816 | 1.3642 | -2.06 | 0.047 |

| R2=0.0090 | ||||

| rho=0.9102 | ||||

| F-test=3.96 | ||||

| F-test=3.96 | ||||

Note: ROA: Return on Assets (dependent variable); PQFIN: Professional qualifications in finance field; logfmz: The log of the firm size, t=t-test.

The results in Table 6 above show that when ROA was utilized as the dependent variable to measure the performance of companies in the healthcare sector, the proportion of professionally qualified members in the financial field has an overall p-value of 0.0286. This value is less than 0.05 level of significance and f-test is 3.96. This implies that postgraduate degree holders in financial fields have a positive and significant influence on the performance of companies in the healthcare sector in Nigeria. This means that for every increase in the number of professionals in the financial field there is a significant effect on the performance of listed healthcare companies in Nigeria. This provides evidence supporting us to reject the three null hypothesis of the study and accept the alternative hypothesis which states that the size of Board members with professional qualification in financial related significantly improve company performance in Nigeria. The result also reveals that LOGFMZ which was the control variable indicates that there is a positive and significant impact between FMZ and ROA for the period under study. The coefficient of FMZ is 7.0 while the probability value is 0.011 which is less than 0.05, indicating a statistically significant impact between the variables under study. The implication of this result is that an increase in the assets of the firm studied will lead to a corresponding increase in the Return on Assets (ROA). This means that the larger the firm grows in size, the more the growth in the Return on Assets (ROA) of the firms in the healthcare sector studied. This finding agrees with the earlier findings of Graham & Harvey (2002), which revealed that Chief Executive Officers (CEOs) with MBAs are more likely to deploy learned techniques, such as NPV and payback period in project valuation.

Generally, we found that the higher the proportion of board members holding degrees in finance-related fields the higher the performance of companies in the healthcare sector in Nigeria. This finding is in agreement with works of Chevalier & Ellison (1999). Also, the proportion of board members holding postgraduate degrees in finance-related fields is positively correlated with return on assets which is the proxy for performance. This implies that the market appreciates firms that have board members with higher education in finance-related fields as better performers than those that are less literate. The findings from the third hypothesis revealed that the possession of professional qualification in the relevant fields in finance leads to greater financial performance. This finding is supported by the earlier work of Gottesman & Morey (2006). Our study further confirms that board financial educations have positive and significant influence on firm performance in the Nigerian health sector. This result corroborates the studies of Jalbert et al., 2002; Haniffa & Cooke, 2008; Agrawal & Chadha, 2005 that found that financial literacy of board members have positive impact on firm performance. The study revealed a positive and significant relationship between the total assets used as the control variable and the performance proxy of return on assets.

Conclusion and Recommendation

This study focuses on the effect of board financial education of board members on the financial performance of Healthcare sector in Nigeria for the periods 2011-2017. Studies in this area are not common among previous researchers. Earlier scholars dwelt more in economies with more sophisticated capital markets. As each nation has their own distinctive peculiarities requiring separate regulatory pronouncements, we analysed the effects with particular emphasis on the Healthcare sector in Nigeria. We used three explanatory variables (BscFin), (PGFin) and (PQFin) to measure board financial education while ROA was used as a proxy for financial performance. We found that the higher the proportion of Board members holding degrees in finance-related fields the higher the performance of companiesin the healthcare sector in Nigeria. We, therefore, recommend that financial literacy should be considered as a primary pre-requisite for appointments to corporate boards. Also, basic financial training should be a top priority for all firms to assure optimum financial performance.

Implication Of Finding And Contribution

The findings of this study provide a major implication for corporate board practices and future sustainability of firms operating in the healthcare sector in Nigeria. A sound corporate board with highly experienced members having financial expertise might likely have a positive impact on firm financial performance. This result would eventually affect the corporate and long- term sustainability of firms. This implies that the role of board members having financial expertise cannot be undermined if firms would continue to enjoy the cooperation of its stakeholders. The policy implication of this study is that financial education should be a major prerequisite in the board selection process particularly in the Nigerian health sector. Also, this study adds to existing literature in the aspect of corporate governance mechanism especially in the area of board financial education in Nigeria. This study provides original insight into board financial education variables that affect the performance of firms operating in the healthcare sector in Nigeria. It carries significant importance for company executives, regulatory authorities, policymakers, and future researchers.

Limitations

This study provides an empirical step towards understanding the relationship between board financial education and company performance. The study highlights few limitations; firstly, this research primarily focused on the healthcare sector without considering other sectors listed on the Nigerian Stock Exchange (NSE). This, however, limited our sample size and number of observation (n=42). Also, looking at the robust findings from the study, other performance variables like Return on Equity (ROE), Tobin’s Q, profit margin and others not taken into cognizance could be beneficial for a wider range of stakeholders. Again, the absence of data for firms not listed in the stock exchange limit the scope of generalization in the entire health sector.

References

- African Progress Report (2017). Power, people, planet: Seizing Africa?s energy and climate opportunities. Retrieved online: http://www. Seforall.org/2017_06_11_power-people-planet-report.

- Agrawal, A., & Chadha, S. (2005). Corporate governance and accounting scandals. Journal of Law and Economics, 48(1), 371-406.

- Akinsulire, O. (2006), Financial management (4th edition). Lagos, Ej-Toda Ventures.

- Ame, J., Arumona, J., & Erin, O. (2017). The impact of ownership structure on firm performance: Evidence from listed manufacturing companies in Nigeria. International Journal of Accounting, Finance and Information System, 1(1), 293-305.

- Awotundun, D.A. (2015). Corporate governance and dividend policy of money Banks in Nigeria. A PhD Thesis of Department of Accounting and Banking & Finance, Olabisi Onabanjo University, Nigeria.

- Barnhart, W., Marr, M., & Rosenstein, S. (1994). Firm performance and board composition: Some new evidence. Managerial and Decision Economics, 15(4), 329-340.

- Bathula, H. (2008). Board characteristics and firm performance: Evidence from New Zealand. A Ph.D. thesis submitted to Auckland University of Technology.

- Bertsch, K. (2011). Theorising of shareholder?s voice and the increased role of boards, 25 for 25: Observations on the past, present, and future of corporate governance-In celebration of ISS? 25th anniversary. Institutional Shareholder Services.

- Bhagat, S., Bolton, B., & Subramanian, A. (2010). CEO education, CEO turnover, and firm performance.

- Biekpe, N., & Kyereboah-Coleman, A. (2006).The relationship between board size, board composition, CEO duality, and firm performance: Experience from Ghana. Journal of Finance and Accounting, 2(1), 23-38.

- Chevalier, J., & Ellison, G. (1999). Are some mutual fund managers better than others? Cross-sectional patterns in behavior and performance. Journal of Finance, 54(3), 875-899.

- Darmadi, S. (2011). Board diversity and firm performance: The Indonesian evidence, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1727195

- Dobbin, F., & Jung, J. (2011). Board diversity and corporate performance: Filling in the gaps: Corporate board gender diversity and stock performance: The competence gap or institutional investor bias. North Carolina Law Review, 89(3), 809-839.

- Donaldson, L. (1990). The ethereal hand: Organizational economics and management theory. Journal of Management Review, 15(2), 369-381.

- Donaldson, L., & Davis, J. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49-63

- Eisenhardt, K.M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57-74.

- Erin, O., Eriki, E., Arumona, J., & Ame, J. (2017). Enterprise risk management and financial performance: Evidence from emerging market. International Journal of Management, Accounting and Economics, 4(9), 937-952

- Erin, O., Olojede, P., & Ogundele, O. (2017). Corporate governance attributes and financial disclosure quality: Evidence from listed firms in Nigeria. ICAN Journal of Accounting and Finance, 2(1), 355-377.

- Golec, J. (1996). The effects of mutual funds managers? characteristics on their portfolio performance risk and fees. Financial Services Review, 5(2), 133-147.

- Gottesman, A., & Morey, M. (2006). Does a better education make for better managers? An empirical examination of CEO educational quality and firm performance. SSRN Working-Paper 564443.

- Graham, J., & Harvey, C. (2002). How do CFOs make capital budgeting and capital structure decisions? Journal of Applied Corporate Finance, 15(1), 8-23.

- Hambrick, D., Cho, T., & Chen, M. (1996). The influence of top management team heterogeneity on firms? competitive moves. Administrative Science Quarterly, 41(4), 659-684.

- Haniffa, R.M., & Cooke, T.E. (2008). Culture, corporate governance, and disclosure in Malaysian corporations. ABACUS, 38(3), 317-341.

- Hernsberger, J. (2016). Investment analysts? impact on CEO appointment. Academy of Strategic Management Journal, 15(2), 47-61.

- Hitts, M., & Tyler, B. (1991). Strategic decision models: Integrating different perspectives. Academy of Strategic Management Journal, 12(2), 327-352

- Horner, S. (2016). CEO directors: Going it alone or clustering on boards? Academy of Strategic Management Journal, 15(1), 32-40.

- Ionascu, M., & Olimid L. (2011). Corporate governance practices and analysts forecast accuracy evidence for Romania. World Academy of Science, Engineering and Technology, 77(2), 947-951.

- Jalbert, T., Rao, R., & Jalbert, M. (2002). Does school matter? An empirical analysis of CEO education, compensation, and firm performance. International Business and Economics Research Journal, 1(1), 83-98.

- Kahveci, E., & Wolfs, B. (2019). Family business, firm efficiency and corporate governance relation: The case of corporate governance index firms in Turkey. Academy of Strategic Management Journal, 18(1), 1-12.

- Kerlinger, F.N. (1999). Behavioural Research: A Conceptual Approach. New York: Holt, Rive hart & Winston.

- Kiel, G., & Nicholson. G. (2003). Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review, 11(3), 189-205.

- Kirkpatrick, G. (2009). The corporate governance lessons from the financial crisis. OECD Financial Market Trends, 11(2), 23-35.

- Kyereboah-Coleman, A., & Biekpe, N. (2005). The relationship between board size, board composition, CEO duality and firm performance: Experience from Ghana. Working paper, UGBS, Legon.

- Miyajima, H., Omi, Y., & Saito, N. (2003). Corporate governance and performance in Twentieth-Century Japan. Business and Economic History, 1(1), 1-26.

- National Empowerment and Development Strategy (NEEDS) (2004). A Publication of National Planning Commission, Abuja (March).

- Oki, E.U. (2015). An evaluation of the impact of corporate governance on the performance of Nigerian Banks. A Ph.D. Thesis submitted to the School of Postgraduate Studies, University of Jos.

- Okoye, L., Erin, O., Ado, A., & Areghan, I. (2017). Corporate governance and financial sustainability of Microfinance Institutions in Nigeria. Conference Proceeding on Sustainable Economic Growth, Education Excellence, and Innovation Management through Vision 2020.

- Okwoli, A.A., Oki, E.U., & Arumona, J.O. (2018). Effect of board size and composition on the financial performance of manufacturing firms in Nigeria. The Nigerian Journal of Management Research, 7(1), 101-116

- Oyeleke, O., Erin, O., & Emeni, F. (2016). Female directors and tax aggressiveness of listed banks in Nigeria. Paper presented at the 3rd International Conference on African Development Issues, 293-299.

- Peters, S., Miller, M., & Kusyk, S. (2010). How relevant are corporate governance and corporate social responsibility in emerging markets? Corporate Governance, 11(4), 429-445.

- Pozen, R.C. (2010). The big idea: The case for professional boards. Harvard Business Review, 88, 50-58.

- Sar, A. (2018). Impact of corporate governance on sustainability: A study of the Indian FMCG industry. Academy of Strategic Management Journal, 17(1), 1-10.

- Seetharaman, A., Rudolph, R., & Saravanan, S. (2010). The changing role of accounting in the health care industry. Research Journal of Business Management, 4(2), 91-102.

- Shammari, H. (2018). CEO incentive compensation and risk-taking behaviours: The moderating role of CEO characteristics. Academy of Strategic Management Journal, 17(3), 1-15.

- Smith, N., Smith, V., & Verner, M. (2006). Do women in top management affect firm performance? A panel study of 2500 Danish firms. International Journal of Productivity & Performance Management, 55(2), 569-593.

- Uwuigbe, U., Erin, O., Uwuigbe, O., Igbinoba, E., & Jafaru, J. (2017). Ownership structure and financial disclosure quality: Evidence from listed firms in Nigeria. Journal of Internet Banking and Commerce, 22(8), 1-12.

- Vian, T. (2008). Review of corruption in the health sector: Theory, method and interventions. Health Policy and Planning, 23(2), 83-94.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.